Individual Income Tax Return Form 2020

The major sources of state tax income are payroll taxes and stamp duties. State governments also impose taxes on land, gambling and motor vehicles. Municipal rates are the only supply of local authorities tax income. While firm tax is paid by companies, the burden is passed on to shareholders, customers and employees.

This isn’t sufficient to significantly distort the progressive nature of Australia’s individual tax system, however does have appreciable revenue implications. Tax offsets in whole are extra focused at those on low incomes, in plenty of circumstances removing them from paying any tax. However, the termination cost offset is second solely to low earnings tax offset in total worth, and is of most benefit to excessive revenue individuals. Table 5 below reveals what proportion net tax fashioned of taxable revenue and gross earnings (as defined in ‘Income’ above) for each of the income ranges. It may be seen that the applying of deductions and offsets reduce the tax paid as a proportion of revenue throughout all earnings ranges. While this hole does improve as incomes rise the distinction is not substantial.

Your new house for clinically confirmed assets and companies to advise, information and support your psychological well being journey. We’re a top-ten performing tremendous fund and our Balanced option has given robust returns for years. These include an industry extensive efficiency test for MySuper products and account stapling, the place your super account strikes with you if you change jobs. For our accounting companies, we begin with your small business targets and guarantee our providers are serving to you nearer to them.

Are You Ready To Do Your Tax Return 2021?

They don’t have the facility to control where the demand flows because the base demand in the financial system for basic items is already enough to set off depreciating buying energy. At least they can’t with out impoverishing individuals with excessive taxes/duties. To hold inflation measurement the identical the government should unwind companies and native inflation which can reverse the benefits of demand pull inflation . Michael has over 20 years of experience as a Chartered Accountant in Adelaide. He believes in taking the time to know every client’s situation to be sure that he can help them get the best tax recommendation and the tax refund they deserve.

The Government is dedicated to delivering the Marinus Link undersea interconnector to attach Tasmania’s Battery of the Nation project to the mainland. We are also investing in 660MW of versatile gasoline with the Hunter Power Project to offer dependable electrical energy when we need it most. These investments are a key a part of our dedication to keep wholesale electricity costs beneath $70/MWh. Viv is a teacher and commutes to the classroom with her small petrol hatchback.

Ten Years As Australias Most Trusted Tremendous Fund

Ten superannuation funds have accounted for more than half of the hardship early launch… An ancillary sub-fund is a quick and cheap way to safe a tax deduction in advance of researching and choosing the proper charities to support at tax time. Anyone who invests in a unit trust in June should a minimal of ask the fund supervisor for an estimate of the distribution and its tax components, unless they want to share the tax burden for prior traders. “Distributions aren’t pro-rated for traders who were not unitholders for the entire period, meaning that you could be receive a few of your funding again instantly as income should you invest just earlier than a distribution.”

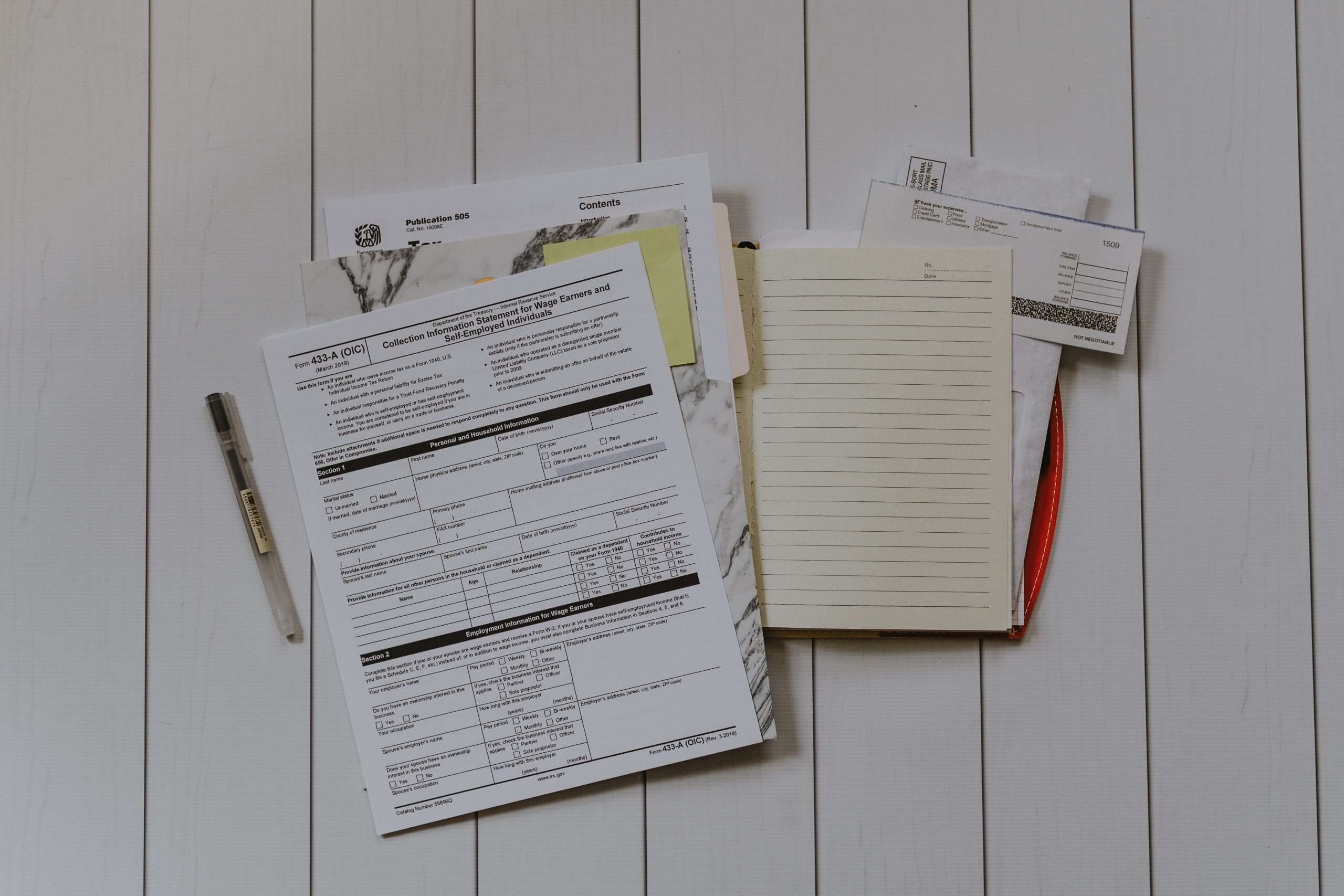

This assist matter is supplied as a guide only, in accordance with our Legal Disclaimer. Supporting schedules and worksheetsthat are not lodged with the ATO. The ATO has extra information about how to calculate working from home bills. If you’re an worker who works from residence, you may find a way to claim a deduction. The ATO have created occupation and business guides to assist you work out what you’ll have the ability to and may’t declare. If your bills meet these criteria, this is an inventory of the stuff you might find a way to claim.

Taxpayers lodging by way of a tax agent will normally get a deferred due date which may be as late as 15 May the following yr. If you plan to use a tax agent, we recommend contacting a tax agent before 31 October. Sometimes the total tax withheld from all sources may be kind of than the amount you want to meet your end of 12 months tax legal responsibility. These tax withheld quantities are credited to you when you lodge your revenue tax return. However, if not enough tax was withheld, the distinction may need to be paid to the Australian Taxation Office so that you’ve paid sufficient tax in your income.

We have an extensive Small to Medium Business shopper base, and in addition to tax considerations we also provide business efficiency reporting and business profitability improvement recommendation. High Net-Wealth Individuals who generally seek recommendation and tax assistance with their investments in monetary devices and investment property. Not only do we make positive that your tax place is optimised, however we additionally provide advice on tax-effective structuring and will work carefully along with your Financial Advisers to realize your required asset protection and financial objectives. If you need to know the way much your employer is required to withhold from payments to you, use ATO’sTax withheld calculator. These charges apply toworking holiday makerincome no matter residency for tax purposes. If you would possibly be beneath the age of 18, and receive unearned revenue , particular rates apply.

Car and travel expenses — If you use your automotive for work, then you definitely may be able to claim a deduction. This doesn’t include the normal cost of travel between work and residential. You can lodge your return utilizing myTax, the ATO’s free online software.

Understand Enterprise Activity Statements Requirements

Deductions were larger than earnings on average for rental properties across all revenue groups. The highest proportion losses had been among those with incomes between $55,001 and $80,000 with deductions exceeding revenue by greater than 28%. In general, the worth of deductions claimed elevated with earnings. However, for some deductions associated to specific forms of earnings, deductions as a proportion of those earnings declined as income elevated. The low earnings tax offset is the biggest worth tax offset in the particular person tax system, and, not surprisingly, low income teams have been the principle beneficiaries. The second largest value tax offset is the termination cost offset.

Every year, most taxpayers want to finish an income tax return, which is a doc that data all of your income for the yr and permits you to work out your tax legal responsibility. Sometimes, your employer will already have paid enough tax in your behalf through the 12 months, so you gained’t owe any tax to the taxman. Often, in fact, you will have paid slightly bit too much tax and you may be eligible for a refund. If you earn different revenue outside your job, or if none of your revenue is from a paid job, it’s most probably you will have to pay tax based on the legal responsibility you calculate in your tax return. Australian individual tax rates are progressive, with greater marginal rates at greater ranges of taxable earnings, and there may be a tax-free threshold under which no tax is payable in most circumstances.

Was there an extension to file 2020 taxes?

WASHINGTON — The Treasury Department and Internal Revenue Service announced today that the federal revenue tax submitting due date for people for the 2020 tax 12 months will be mechanically prolonged from April 15, 2021, to May 17, 2021. The IRS might be offering formal guidance in the coming days.

The taxation system is complex, and as such, businesses and individuals rely on each sensible and sound recommendation so as to optimise their tax obligations. We will assist you to uncover all of the work-related deductions you might have. We may even help you via Salary Sacrificing rules to see if it will work for you. Through the Covid-19 work at home interval we now have written a brief information to tax deductions you can declare while working from home. Investors don’t have an offset account attached like folks trying to repay their homes either.

Dividend imputation ensures there is no double taxation on income from Australian shares owned by Australian resident shareholders and helps the integrity of the enterprise tax system. However, it makes little contribution to attracting overseas funding to Australia aside from eliminating dividend withholding tax for franked dividends paid to foreign shareholders. It additionally involves a significant price to income and will impose extra compliance costs to achieve comparable outcomes to different jurisdictions. This is because the tax improve for people with lower incomes is larger as a proportion of their earnings than for those at larger incomes. Rental properties are some of the well-liked types of funding in Australia. As with different investment revenue, the rent you obtain out of your rental property is taxable, and there are plenty of guidelines concerning what you’ll find a way to claim as a rental deduction.

Further recommendation is supplied by many different teams, including tax practitioners, industry groups, think tanks, the public and the media. Tax administration is more and more necessary to minimise the influence of tax system complexity and to make it easier for taxpayers to adjust to their obligations. The complexity largely reflects the historic foundations of the tax system and the means in which modifications to the system have been carried out in the past. This makes it troublesome to handle without broad group help. Navigating a fancy tax system is disproportionately burdensome for small businesses, particularly as certain options of the system can encourage them to undertake explicit authorized structures which would possibly be expensive to determine and maintain. Tax settings for financial savings ought to give people the incentive to save lots of for their future, however variations within the taxation of other savings vehicles affects savings choices.

September sixth, 2020 Reply means your tax agent hasn’t lodged it but. Same thing happened to me. 2 weeks after my appointment with tax agent, i got on to the ato for something unrelated & saw it was “due”. Emailed tax agent to enquire, then coincidentally, the day after my email, it was lodged. If they’ve declared insolvency or entered into a Part IX agreement, the ATO needs to undertake further checks before it could finalise a tax return. It may must contact payers, monetary establishments, personal health insurers or the taxpayer themselves to verify or cross-check info in their return. A taxpayer usually doesn’t need to take any action – if the ATO wants any further info, it’s going to allow them to know.

Online Saver

Often clients will tell us that they cannot discover their old Tax Returns, which is why they’ve provided a Notice of Assessment. Expert arrange and support, we’ll take the time and hassle out of managing your books. Generally, you’ll find a way to declare any donation you made above $2 if it was to a ‘deductible gift recipient’. You canfind out extra about course bills you’ll have the ability to claimat the ATO website.

- Taxpayers lodging through a tax agent will usually get a deferred due date which can be as late as 15 May the next year.

- This can embody your PAYG summary plus income from financial institution interest and Centrelink.

- Refer to those for more detailed details about how a specific calculator works.

- Whether it be life insurance or earnings protection, you possibly can have peace of mind in your family’s future.

- The ATO could ask you to supply proof to support any claims you make.

- Just send your accountant a message immediately using the “my messages” hyperlink within your Etax account.

The Australian Government won’t assist changes to the GST and not using a broad political consensus for change, together with settlement by all State and Territory governments. Governments present a selection of tax concessions to support the NFP sector. While these tax concessions help increase the level of exercise in the NFP sector, the value of income forgone from the concessions is critical and rising steadily. The effect of the tax system on the combination stage of home financial savings is unsure.

What is the deadline for 2020 tax return?

The filing deadline for tax returns has been extended from April 15 to July 15, 2020. The IRS urges taxpayers who are owed a refund to file as quickly as potential.

This assumes the earnings would in any other case be taxed on the marginal tax price of 45c within the $1 over $180,000, plus the 2% short-term finances restore levy and the 2% Medicare levy, which means a complete of 49% tax. While there are clearly some deductions which would possibly be of much more value to those with high incomes, in plenty of instances this reflects their greater revenue in the related space and the elevated complexity of their tax affairs. Rental deductions are the biggest deduction on average throughout all revenue ranges, with deductions being higher than the earnings received in aggregate for all income groups. The personal medical insurance tax offset determine only applies to those that claim this offset by way of the tax system, somewhat than by way of lowered premiums. Table 2 beneath exhibits the variety of tax filers in every whole income group, the proportion of filers in each group, and the comparative taxable, complete and gross incomes for every group.

Find our more about https://amoura.com.au/individual-tax-return/ here.