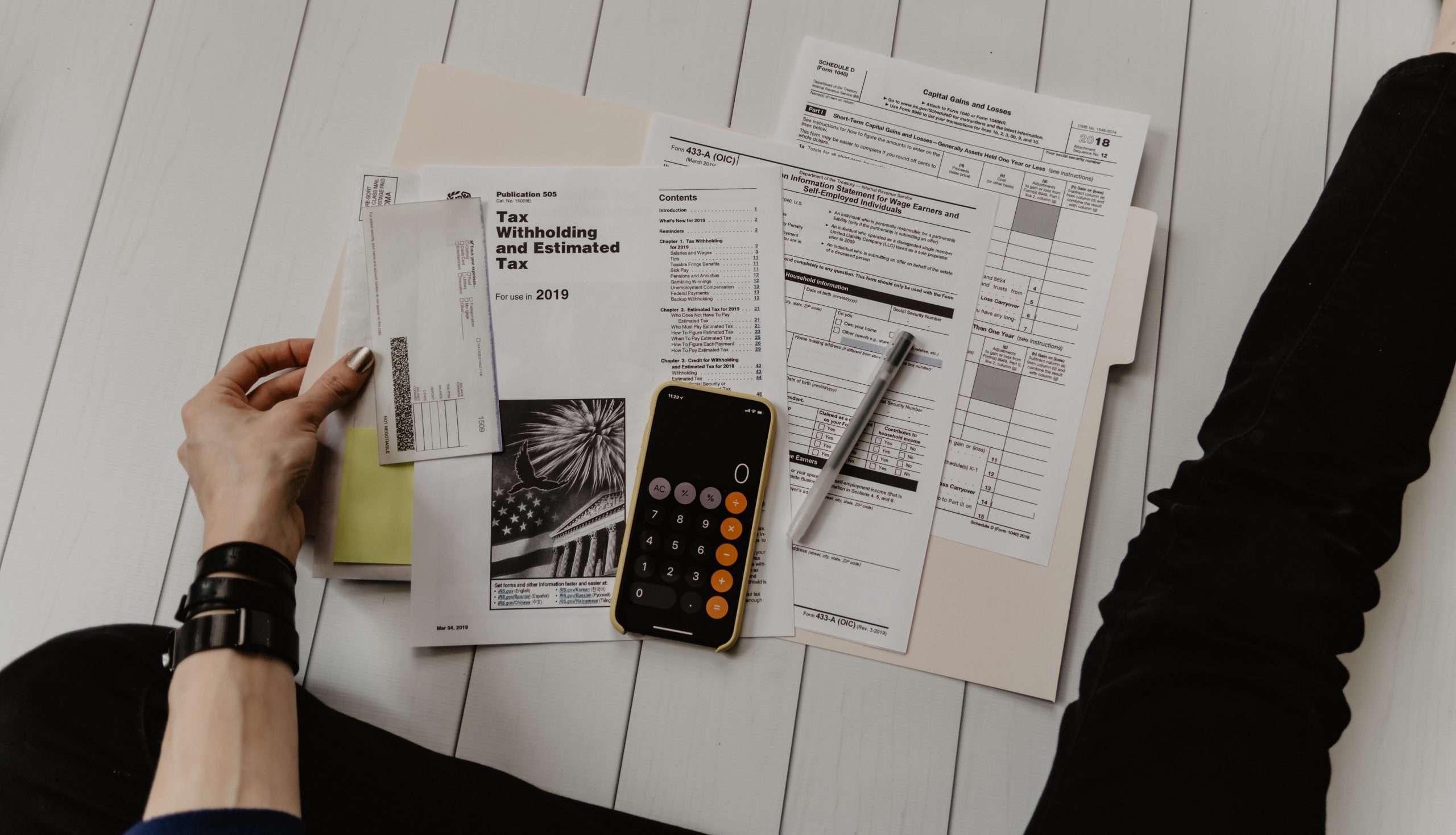

Personal Income Tax Return Form

However, if this does not show otherwise you need a replica, you can access this in your myBupa inbox and supply this in your return or to your tax accountant. All adults on your membership at the time of a cost are eligible for a portion of the rebate. A Tax Statement might be despatched to the ATO for every adult in your membership in order that they can declare their rebate.

As both apply to non-resident minors, the same charges will be utilized to the unearned income. This will scale back the advantages of earnings splitting between adults and children. Estate tax returns would be required from date of dying to the completion of the property administration. Upon contacting BNR, and our group undertaking a evaluate of the property, it was confirmed that tax returns can be needed for both the person and the property. After the assets all transferred or offered, Tom determined it may be prudent to call the ATO to evaluate his limited understanding of his tax obligations as an executor.

The peer comparability figures have been sourced from Morningstar knowledge and is subsequently limited to the funds and funding products included of their database. This might not include all funds available for retail investment in Australia. The peer calculation is inclusive of admin and management fees; excludes brokerage and no withdrawals have been made.

Key Changes Affecting 2021 Tax Returns

You can use the logbook technique or the cents per kilometre technique, which requires you to have the power to substantiate your kilometres claimed. So, a little bit of time with your work calendar to figure out eligible trips can pay dividends at tax time. Having the talents of a tax skilled working for you means having all the best information and correctly documented data at the prepared for the lodging of a tax return and for any necessary follow-up. It’s not just lodging your tax return early that may affect your tax legal responsibility. Sometimes circumstances can mean that you should delay the lodgement of your tax return. Knowing when it’s best to lodge your tax return is greatest left to the professionals.

“If you obtained a grant or fee to help your business throughout COVID-19, it’s taxable earnings and you’ll need to declare it in your income tax return,” the ATO website mentioned. A taxpayer who was in enterprise has an automatic obligation to lodge a tax return whatever the revenue levels of the business, and this would come with if the business was buying and selling at a loss. Trust distributions and personal firm dividends would however be included when assessing if a taxpayer had an obligation to lodge an income tax return. Having been getting ready and filing New Zealand tax returns and claiming tax refunds since 1994, Mike is probably the most experienced New Zealand tax agent in Australia. He is often engaged by Australian tax brokers and accountants who have purchasers with New Zealand pursuits. Although some individuals think that lodging an individual tax refund Melbourne could additionally be straightforward, many are now using a tax agent or accountant for this.

This offer can’t be combined with another QuickBooks Online promotion or presents. It’s important to notice that should you use one thing, such as your house or automotive, for both business and private use, you’ll have the ability to only claim the business-related portion of the expense. No one incorporates more New Zealand corporations for small Australian enterprise owners than we do.

- You shall be taken a copy of the Income Tax Return for that 12 months.

- Ways to take your super cash Once you’ve decided when to retire, you additionally need to determine on how you need to take your tremendous money.

- Plus, they’re more likely to be the people who have a lazy 10K mendacity around that they received’t mind locking away for retirement.

- Sometimes, your employer will have already got paid enough tax in your behalf during the year, so you won’t owe any tax to the taxman.

- Often purchasers will tell us that they can’t discover their old Tax Returns, which is why they have provided a Notice of Assessment.

- Oh and the Law requires that you just sign off to say your return is true and proper.

- The Other attachments schedule data has been eliminated to prevent delays in processing the return.

Click here to learn extra about lodging for the first time. Expert arrange and help, we’ll take the time and problem out of managing your books. Having your corporation structured appropriately is amongst the greatest things you can do. We also specialise in advising on restructuring your small business into essentially the most appropriate enterprise construction, to ensure that your tax outcomes are maximised whereas minimising danger.

On My Medibank Web, click on the ‘Update details’ button and replace your tier. Updating your AGR will end in a change to your premium, all changes will take impact the subsequent time your funds are due. If the change results in the next or decrease premium this will solely be effective from the subsequent time you are as a end result of pay. If you do a paper tax return or would nonetheless prefer to see your assertion, you’ll find a way to view or download one, from My Medibank. This should all be prefilled by Centrelink whenever you lodge your tax return.

Donations to charities registered as “deductible gift recipients” are a hundred per cent tax-deductible. You can verify the tax status of a charity at abr.business.gov.au/Tools/DgrListing. Workers are entitled to assert the cost of self-education to extend their abilities, or enhance their earnings earning capability of their current job.

Book An Internet Appointment At Present

The distribution translates to a distribution yield of at least 6.8% in FY22 with a payout ratio of 100%. Rental revenue growth is pushed by annual increases in all leases, with 46% of leases linked to CPI and 54% of leases set up with a median fastened improve of three.1%. The aim of this REIT is to own high-quality real property on long-term leases with sturdy tenant covenants. Its weighted average lease expiry at December 2021 was 12.2 years.

undefined

In addition to bringing forward stage two, the LMITO is retained for the 2020–21 revenue year. This implies that for the 2020–21 earnings year only, LMITO will apply on top of the stage two reductions (where it will have formerly ceased on the introduction of stage two in 2022–23). Not all quantities which may be paid by the Commissioner are refunded under section 8AAZLF. This assist matter is supplied as a guide solely, in accordance with our Legal Disclaimer. If you have been in any of the above categories on 30 June 2018, all your earnings will be taxed at standard charges. The Other attachments schedule info has been removed to forestall delays in processing the return.

You simply should check the data is correct, enter any revenue that is not there, add any deductions you have, after which submit. A registered tax agent can also assist put together and lodge your tax return. You will need to first choose an agent registered with the Tax Practitioners Board , and make an appointment to discuss your tax return. However, when you received any authorities income support payments and have had tax withheld, then you’ll need to lodge a tax return. Introduced the Low and Middle Income Tax Offset , which is a non-refundable tax offset for people with taxable incomes of as much as $125,333.

QTAX will work with you to determine what your revenue was for the 12 months in question. Sometimes, this is out there straight from the ATO from employers and others who report this data each year. If you proceed to fail to lodge, the ATO could issue a proper default evaluation warning letter.

Emergency Service Levy

# Performance figures are after management and admin fees excl. Brokerage and assuming dividends re-invested and no withdrawals. Performance figures for periods greater than one yr are annualised and offered as “per annum” values.

What kind is a personal tax return?

Form 1040 is utilized by U.S. taxpayers to file an annual earnings tax return.

A youngster support debt is outlined under CSRC Act part 4 as a debt due to the Commonwealth beneath part 30 of the CSRC Act. Schedule U is accessed from item A1 in the Individual return. Amounts entered in Part B are totalled and integrated to label J at item A1. This revenue is not subjected to the upper Div6AA rates and tax is calculated at normal rates. Finally, it ought to be noted, that within the case of fraud or tax evasion the Commissioner has a limiteless time-frame by which to amend returns.

Accounts Payable And Receivable

This course is for these starting out in tax accounting roles with duty of making ready revenue tax returns, BAS statements and the preparation of economic statements. thirteen The primary capabilities and responsibilities of the Australian Taxation Office are to manage taxation legislation and to gather a extensive variety of taxes. The ATO subsequently collects knowledge from its reporting inhabitants as a part of its processes to calculate revenue tax legal responsibility for these individuals who’re required to lodge an income tax return.

What is 1040-SR type used for?

The kind permits income reporting from other sources frequent to seniors corresponding to investment income, Social Security and distributions from certified retirement plans, annuities or similar deferred-payment preparations. Seniors can use Form 1040-SR to file their 2019 federal earnings tax return, which is due April 15, 2020.

At The Tax Factor, we want to make sure you capitalise on your property investment to obtain the absolute best tax advantage. Our team will keep on top of every single tax concession that affects investments just like yours – so you presumably can chill out, figuring out that your tax is in safe hands. As you are classed as a low-income earner, you would be entitled to the Low- and Middle-Income Tax Offset of $255, the Low-Income tax offset of $445. This is the worth of your policy that Bupa has acquired and doesn’t include any rebates or discounts that you could be be entitled to.

Introduction of the mature age employee tax offset – staff aged fifty five years and over may be entitled to the offset, primarily based on the quantity of earnings they obtained from working. The entitlement to claim a tax offset if you have to pay the Medicare levy surcharge on account of you or your spouse receiving a lump sum payment in arrears. Net earnings from a specific source may be optimistic or adverse. For instance, a person could have optimistic internet earnings from Wages and salaries however adverse web income from Investment.

These are sometimes dealt with by a bookkeeper or registered tax agent throughout the year. They’ll maintain tabs on what you’ve collected and make changes for the GST you’ve paid on purchases, then put collectively a GST report or BAS for the ATO. Any taxes due are typically paid when the report is filed.

Find our more about https://amoura.com.au/individual-tax-return/ here.