Individual Tax Return 2021

If you’re considering placing some cash down in your dream home, there are a quantity of essential components to think about. Insights and help Back to menu Insights and assist AMP share experience and specialised assist that can help you keep on prime of matters that matter to you, your small business and your clients. When you’re done, we’ll get in contact along with your quote inside one enterprise day. Some of you would possibly have heard within the Media that the ATO are wanting to crack personal on Work Related Deductions that workers are claiming in their Income Tax Returns. There is no have to book an actual appointment time except you have particular questions to ask. We will provide you with a buzz once we are making ready your return if we now have any questions.

Look for critiques that match the service sort, for instance, in case you are taking a glance at hiring a tax accountant to complete and lodge a tax return it would be best to examine reviews that relate to tax return companies. Finding someone who you’ll have the ability to work with who understand both your state of affairs and the way you use as a business or particular person is extremely necessary because the individual you choose will be serving to make important life choices. Rather than seeing them as a annually necessity the right accountant should be succesful of provide you or your corporation with lifelong monetary advice and support. You must additionally lodge a person tax return for revenue you earn via wages, shares and dividends from the company. Company tax returns can be lodged utilizing SBR enabled software, via a registered tax agent or by paper.

Reliable sources of data embrace the Australian Taxation Office , your accountant or monetary planner. Once you’ve lodged your tax return, ensure you maintain all of your data of expenses. The ATO may ask you to provide evidence to support any claims you make. You may be able to declare some expenses as tax deductions to cut back your taxable earnings.

Personal Tax Return 21 Plus

However, with slightly assist it doesn’t need to be so stressful. Register or login to myBupa to update your details on the go, review your stage of canopy or make a variety of claims online. If you have not already and would like to handle your account online, you’ll have the ability to register for myBupa here.

The ATO can problem Departure Prohibition Order and this order would require you to fully pay the tax debt before your friend can go away the country once more. The course of concerned to lodge your business tax return will differ depending on should you’re a sole trader, partnership, trust or a company. In addition, should you lodge your return after the deadline and incur a debt, the ATO will charge you curiosity on that debt from the date it was due till you end up paying it. The basic interest charge price that applies to unpaid tax liabilities is reviewed quarterly, and for July to September 2017 was set at eight.73% p.a. If you’ve did not lodge your return in time, the ATO will notify you in writing or over the telephone.

Why is my 2022 refund so low?

These refundable tax credits paid you prematurely against your future tax refund and in some cases when you have been over paid or your tax state of affairs changed (income, dependents, filing status etc) then the IRS might have modify refund to cowl the difference. This would lead to your tax refund being lower than expected.

A Tax Statement will be despatched to the ATO for every grownup on your membership in order that they can claim their rebate. If you wish to obtain a duplicate of your tax statement you’ll be able to access this by way of myBupa. Or if you’re not capable of, you presumably can contact us after 6 July 2022 to request a duplicate to be despatched out to you. This excludes dependant youngsters who don’t get issued a Tax Statement. Those with Overseas Visitors cowl is not going to obtain a Tax Statement.

“One explicit expense you could possibly claim a deduction for in case you have more than one job is for travel between workplaces on the identical day, supplied one of those workplaces just isn’t your house. ATO taxation statistics show that fewer landlords have been making losses on renting out their properties, largely due to lower interest rates. We do not function a Trust Account, and therefore can’t take our fees from your refund. It is your obligation to offer us with all data that you just fairly anticipate shall be needed to allow us to carry out work contemplated beneath this engagement inside a well timed manner or as requested. You are required by legislation to keep full and accurate records relating to your tax affairs.

What’s The Tax

Some employers expect their employees to maintain a well-groomed appearance at work. This may involve regular hair cuts, being clear shaven or wearing make-up and so on. However, you can’t declare a tax deduction for personal grooming and haircuts for most occupations. A bookkeeper’s key function contains information entry, expense tracking, payroll processing, bill and receipt management, compliance, banking and monetary reporting.

Please seek the advice of your legal practitioner, skilled adviser or the related authorities or statutory authorities earlier than making any selections. The SBR ebMS3 software program developer package information identifies the vital thing parts and performance that comprise the SDK solution. Some of these components are re-used from the beforehand released SBR Core Services SDK and therefore the reader is pointed to the reference for present documentation. For the model new elements, this doc will define the usage details and the API specification . The ATO has extra information about investment earnings deductions. Self-education expenses — If the research relates to your current job, you possibly can claim expenses like course charges, pupil union charges, textbooks, stationery, internet, house workplace expenses and professional journals.

This method allows individuals to assert eighty cents per hour for all their running bills, rather than needing to calculate specific running prices. The ATO will be paying shut consideration to how individuals apportion items similar to internet and telephone prices between private and business use, and anticipate people to maintain good records of the variety of hours worked at house. As tens of millions of Australians prepare for tax time, the Australian Taxation Office is warning people in opposition to making unsubstantiated deductions. The data contained on this website is not meant to be recommendation.

In offering your phone number, you consent to Medibank contacting you about medical health insurance. On My Medibank Web, click on on the ‘Update details’ button and update your tier. Updating your AGR will lead to a change to your premium, all adjustments will take effect the next time your funds are due. If the change ends in a better or lower premium this can solely be effective from the following time you are due to pay.

We All Know How Useful Your Staff Are To The Success Of Your Small Business As One Of Australias Largest Super Suppliers With Top

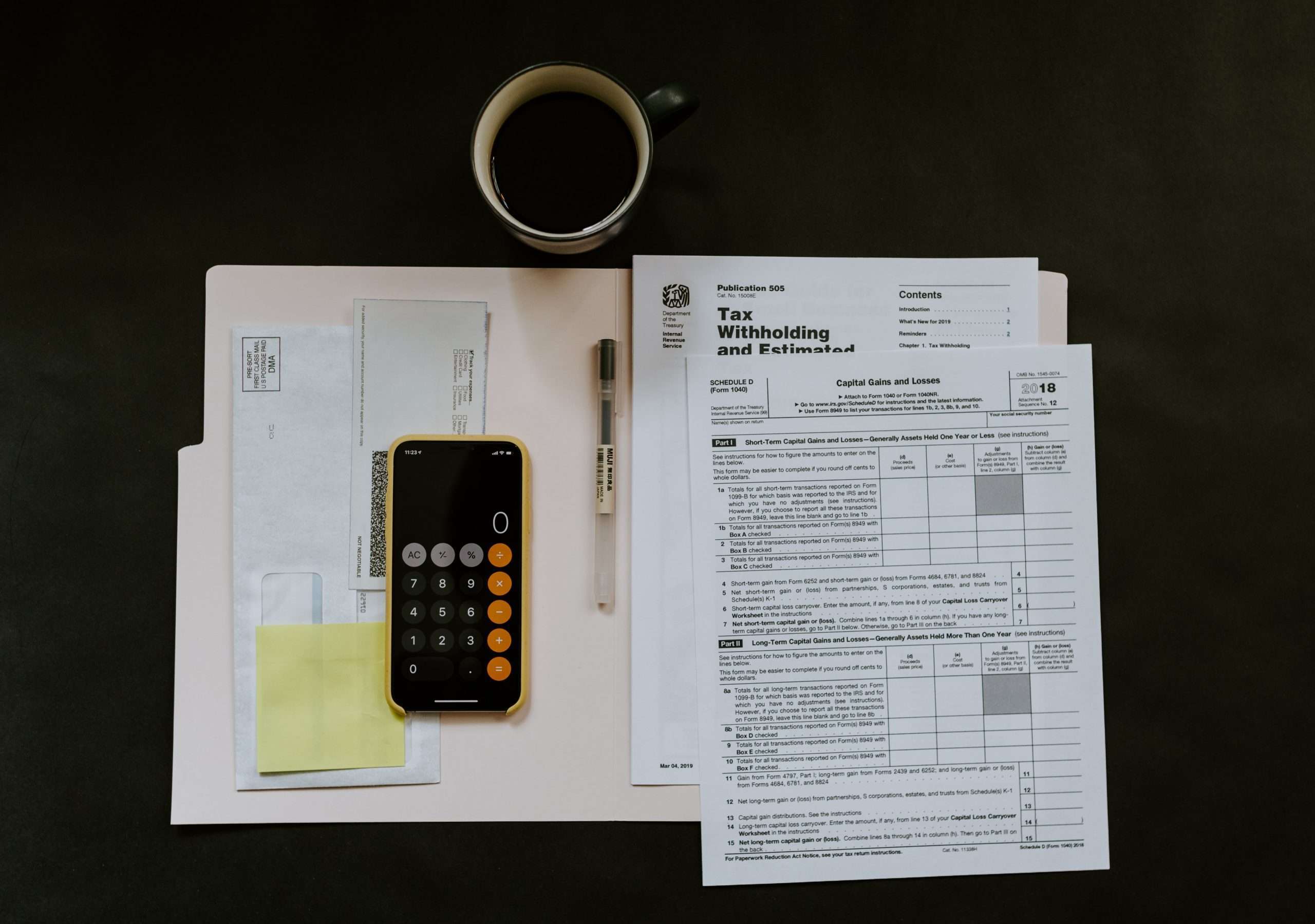

What this implies is you presumably can claim 80 cents for every hour you labored from home to cowl any eligible tax deductions , somewhat than doing calculations for specific gadgets. The ATO has introduced that a ‘shortcut’ methodology will again apply as an choice for calculating related tax deductions for anybody who has worked from house in the course of the financial year 1. If you’re having hassle maintaining monitor of all of your receipts, checkout the myDeductions tool in the ATO app. This lets you save a report of your deductions throughout the monetary year, which you will find a way to then upload at lodgement time.

The cost of renewing a driver’s licence can be a personal expense. A deduction just isn’t allowed for the price of acquiring or renewing a driver’s licence. The structure of your corporation can influence the worth quoted, as completely different enterprise buildings have different tax requirements. Home loans are subject to approval from the lending establishment and Raiz Home Ownership makes no warranties as to the success of an utility till all related information has been supplied. This info could additionally be based mostly on assumptions or market conditions which change with out discover and have not been independently verified.

When can I file my 2022 tax return?

WASHINGTON — The Internal Revenue Service announced that the nation’s tax season will start on Monday, January 24, 2022, when the tax agency will start accepting and processing 2021 tax year returns.

Taxation issues are common and based mostly on current taxation legal guidelines and may be subject to change. You should seek independent, professional tax recommendation earlier than making any decision based on this information. It’s essential to remember that tax laws are advanced, and you must make certain that you’ve confirmed you possibly can declare an expense earlier than together with it in your tax return.

With the 2020 EOFY behind us for one more 12 months, I thought now could be a good time to look again on the questions we were most requested and populate FAQs to assist with tax returns in 2021. For some folks, overdue tax returns are an enormous supply of stress, however that stress is basically unnecessary. With the right assist, it might be reasonably priced and simple to get on prime of late taxes. If you receive a fine for lodging your tax return after the deadline, our team of tax consultants can contact the ATO on your behalf and attempt to get your penalties cancelled or reduced. If you’re not sure where something goes on the return, simply use the “Any other questions or documents” section down on the bottom of your Etax return. Then after you sign your return, our accountants will ensure your info goes into the proper part of your tax return.

The Worth Of Managing Your Tax Affairs

It isn’t personal recommendation, and you shouldn’t rely on it, even when the instance is just like your own circumstances. Whether you would possibly be an individual taxpayer, small enterprise owner or even a self-managed super fund trustee, you would possibly also need to contemplate downloading the ATO app. It includes a key dates tool you could tailor to your wants, so you realize what dates you’ll need to meet personally for tax reporting and payments. Whichever way you select to lodge your tax return, keep in mind you might be responsible for the claims you make. So make certain your deductions are respectable and also you include all your revenue earlier than you or your agent lodges your return. The following outlines frequent types of deductible bills claimed by individual taxpayers, corresponding to employees and rental property homeowners, and a few methods for increasing their deductions for the 2021 earnings yr.

- Net expenses are your whole eligible medical expenses minus benefits from Medicare, National Disability Insurance Scheme and private well being insurers which you or another person, received or are entitled to receive.

- We present instruments so you presumably can type and filter these lists to spotlight features that matter to you.

- The price of a tax accountant varies in accordance with state, firm structure, tax return type, the complexity of related issues, and more.

- We perceive that an accountant’s workplace isn’t a super place to visit, so we goal to make your expertise as welcoming and cozy as potential.

- We will ship you an e-mail when it’s out there on your account.

- Accountant Ben Johnston said the ATO has carried out an unlimited knowledge matching marketing campaign working with state motor vehicle registries to collect knowledge on firm owned vehicles in addition to individual’s vehicles.

- If you could have rental earnings, then any expenses associated to rental income may be claimed such as land tax, bank interest , depreciation , council , water, restore, insurance, pest management , legal charges and so on.

At this time we realise that nose to nose conferences may be daunting for some prospects. We have created a system that may alleviate these considerations by making an internet Tax Consultation Booking System that features a phone session and your Tax Return Submission. Note this is not an exhaustive information; quite a basic define of what’s required. Additional data might must be equipped at a later date depending in your particular person circumstances and we are going to guide you through this process. Generally speaking – however not definitively – if you are an Australian resident who earned more than $18,200 in the last monetary 12 months, you are required to submit a return. “If you are discovering it exhausting to pay on time, you can request a payment plan.”

It takes just some minutes on-line, with stay on-line help to help enhance your refund. Book together with your local office – With over 400+ places of work nationwide, e-book an appointment to see one of our tax professional in-office right now. The Australian Taxation Office is reminding Aussies who acquired sure COVID-19 disaster funds that they should be disclosed. Then, if there are objects in your return that increase the tax man’s eyebrows, you’re going to need to wait a bit longer while the ATO manually checks. It’s also value noting that if you’re too hasty to lodge, you’re more prone to have made some errors on your return. Your revenue statement might be marked as “tax ready” once that is accomplished.

Keep receipts using the myDeductions tool in the ATO app and make it simpler to do your tax return. MyDeductions permits you to record deductions together with work-related expenses, gifts and donations, interest and dividends. It additionally allows you to retailer photographs of receipts and record automotive trips. Clothing, laundry and dry-cleaning expenses — To declare the cost of a piece uniform, it must be distinctive and distinctive. You may be able to claim a deduction for occupation particular clothes, like chef’s chequered pants or protecting (‘hi-vis’) clothing that’s required to meet security standards.

Find our more about https://amoura.com.au/individual-tax-return/ here.